So that you can be authorized for a $500 individual personal loan, you’ll have to establish you've got enough earnings to repay the lender. Many lenders require a minimum amount credit score of 580, While Other folks will qualify you thru cash flow and bank statements.

WalletHub editorial content on this website page is just not provided, commissioned, reviewed, accepted or otherwise endorsed by any business. Furthermore, it is not any corporation’s duty to ensure all inquiries are answered.

The amount of does each lender charge to borrow? Are classified as the service fees comparable throughout the board, or are some steeper than Other individuals?

Brigit is another revenue-borrowing app that permits you to borrow as many as $250 with no going through a hard credit history Examine.

It's important to notice that any personalized personal loan you obtain using a 450 credit rating rating is probably going to have a quite superior APR and an expensive origination payment. If possible, you may want to make an effort to borrow... browse entire reply What unsecured loans can I get with undesirable credit score? Here are a few lenders which offer unsecured financial loans for negative credit score, such as Avant, Realize Personal Loans and LendingPoint.

Our best-rated lenders will not be the most effective healthy for all borrowers. To find out more, study our entire personalized loans methodology.

Rapidly Personal loan Immediate encourages knowing the nuances of private financial loans, highlighting that while applying for the utmost volume can handle large economic demands, it may produce increased repayment burdens. The organization advises borrowers to meticulously Consider their repayment capabilities as well as the real necessity on the bank loan dimensions, aiming to harmony fast money alternatives towards opportunity extended-phrase hazards.

Whilst you might be able to find a no credit rating Look at loan and get authorised, be sure you carefully comprehend the stipulations just before agreeing to one.

Our lenders may well execute credit history checks to determine your credit rating worthiness, credit standing and/or credit rating potential. By submitting your ask for you conform to enable our lenders to validate your personal data and Look at your credit rating.

Previous success Will not forecast foreseeable future results, although the table under shows that this ETF isn't any slouch -- and that is accurate for other very low-charge index cash which keep track of the S&P 500.

Significant borrowing expenses: Lender charges as well as fascination you could possibly pay out on these loans could make them a costly source of funding. Likely addictive: The benefit of access and rapid funding instances set you susceptible to regularly relying on revenue-borrowing apps when dollars stream issues occur.

If you have opinions or questions on this text, remember to e mail the click here MarketWatch Guides team at editors@marketwatchguides.com.

Also, some lenders are featuring coronavirus hardship loans that might be simpler to qualify for In case the pandemic has impacted your work. These tiny crisis loans may possibly have very low or even 0% fascination, according to the lender.

Personal debt Cycle: Stay away from payday financial loans in the event you’re concerned about having trapped inside a cycle of credit card debt. The shorter repayment period and substantial prices can result in repeated borrowing.

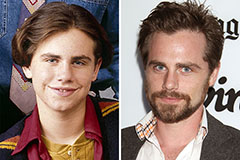

Rider Strong Then & Now!

Rider Strong Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!